Finally, Illinois has a state budget after more than two years without one. I, for one, am glad, even though it means my taxes will rise (gasp!) … because the truth is, they would have risen a whole lot more down the road if this state had continued to (attempt to) operate without one. Credit rating agencies were threatening to cut Illinois’ bond rating to junk status if no budget emerged by July (we’re still not assured that won’t happen anyway), and that would have caused the problem to spiral further out of control.

Finally, Illinois has a state budget after more than two years without one. I, for one, am glad, even though it means my taxes will rise (gasp!) … because the truth is, they would have risen a whole lot more down the road if this state had continued to (attempt to) operate without one. Credit rating agencies were threatening to cut Illinois’ bond rating to junk status if no budget emerged by July (we’re still not assured that won’t happen anyway), and that would have caused the problem to spiral further out of control.

At some point the bill would have come due. When it did, the bill—as big as it is now—would have been much larger.

So yes, I’m resigned to seeing my taxes go up, not just because I’m worried about the effects Illinois’ budget crisis already has had on government services I hold dear but also because operating without one was the worst fiscal move possible.

Gov. Bruce Rauner opposed the budget and is crying alligator tears even though it gives him a functioning state government for basically the first time since he took over the State House. He decries the tax increase, even though the same increase was part of the Republican budget proposal he endorsed. As Eric Zorn pointed out in the Chicago Tribune, “He got the tax increase he knew he needed. The higher rates were also part of the Republican plan.” And the accompanying spending cuts are nearly $1 billion more than Rauner had proposed.

That said, no one ever wants their taxes to go up. For those who aren’t certain that passing a compromise spending plan was the right move, there’s a short video (embedded below) from Illinois Comptroller Susana Mendoza that outlines exactly why this needed to happen.

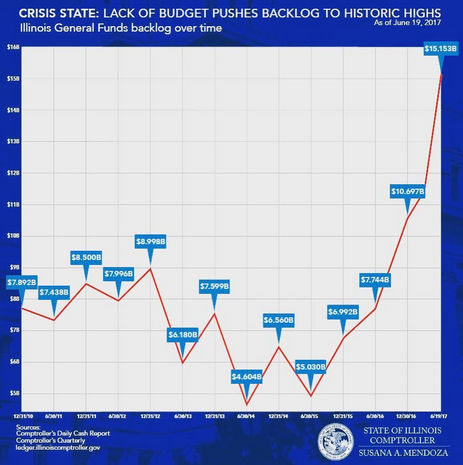

“Three years ago, bond rating agencies said Illinois was on the right track, paying down its backlog of unpaid bills. The backlog was down to $5 billion at the end of fiscal year 2015,” according to Mendoza. “While the governor is not to blame for the debt he inherited, …rather than fix it in his two years … Governor Rauner has tripled that unpaid backlog to $15 billion. He burdened taxpayers with more than $800 million in late-payment interest penalties that our citizens will still be paying off years after Governor Rauner has moved on.”

That timeline is shown in this chart from Mendoza’s office tracking the backlog of unpaid state bills over time:

“In just the past year, (Rauner) charged $600 million more of your tax money every month to the state’s credit line,” says Mendoza. “The late-payment interest penalties alone (now) grow by $2 million a day.”

“In just the past year, (Rauner) charged $600 million more of your tax money every month to the state’s credit line,” says Mendoza. “The late-payment interest penalties alone (now) grow by $2 million a day.”

Mendoza is a Democrat who has been in a public feud with Rauner, and I wouldn’t be surprised to see her running for his job some day. But her video is worth watching because it has the data that supports the need to end the budget stalemate we were in.